Strategies for FMCG brands to thrive in Kenya

The rate of inflation in Kenya edged down to 6.6% in December 2023, from 6.8% in the previous month – the lowest since April 2022. FMCG price inflation was still high, though, with consumers paying 7.7% more for food than they did in December 2022.

This reality led to a 6% year-on-year decline in the frequency of shopping trips, in parallel with a reduction in basket size of 1%. Total FMCG volume in the country declined -5%, with a 2% increase in spend.

The drop in consumption can be seen across most of the FMCG sectors. The biggest impact was felt in the food sector (-10%), followed by non-alcoholic beverages (-6%). Food and dairy were hardest hit in terms of shopping frequency, both suffering a decline of 7%, while volume per trip fell furthest in food (-5%) and non-alcoholic beverages (-4%).

The only sector not facing these challenges was home care, where a rise of 5% in volume was matched by an increase in spend of 5%. Shopping frequency also bucked the trend, with growth of 1%, along with a 2% increase in volume per trip.

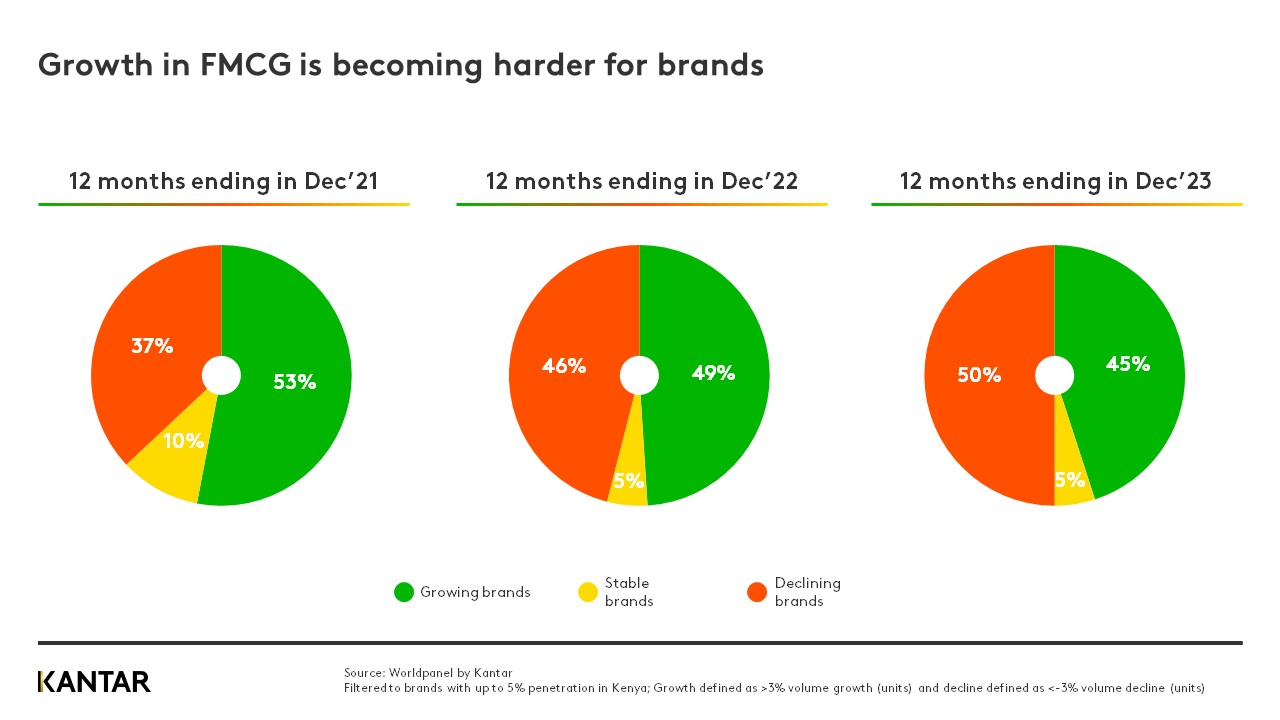

Most brands are in decline

In December 2021 53% of brands were growing in Kenya; in December 2023 this figure had fallen to just 45%. In the beverages and dairy categories, more than half of all brands are in decline, compared to 38% of home care brands.

In food, the entire category is facing decline apart from the culinary, flour and cereals segments. Other FMCG categories that are managing to weather the storm and grow include cocoa & chocolate, yogurt, lotions, deodorants, feminine care, hair care, insecticides, fabric treatments, toilet cleaner, bleach, and air fresheners.

Overall, categories with lower penetration are suffering more than those with a larger footprint. This is particularly marked in beverages, where frequency for brands with the lowest penetration plummeted 26% in one year.

Where are consumers shopping?

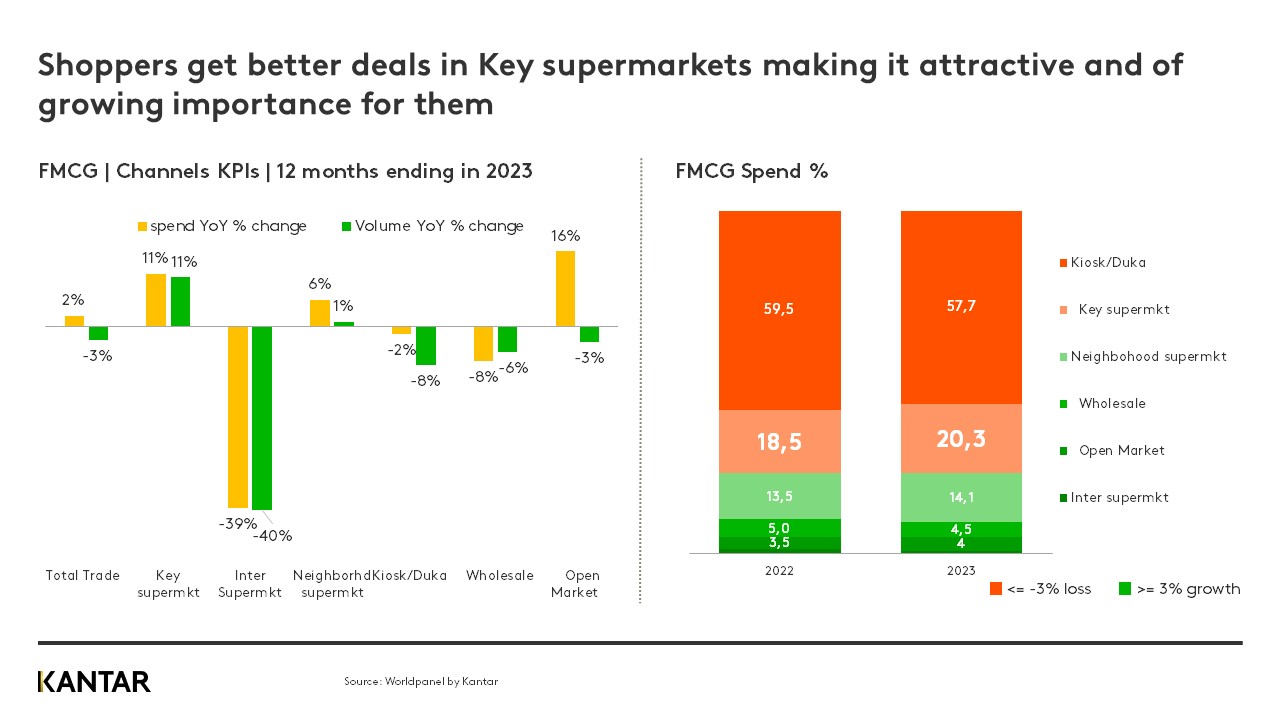

Key supermarkets are growing in importance in Kenya, as shoppers are attracted by the better deals they get in this channel. Both spend and volume have increased 11% year-on-year. It’s a very different story for international supermarkets, with significant drops of 39% and 40% respectively.

A huge 57.7% of all shoppers’ FMCG budgets is spent in kiosks, making it essential that brands are present within this channel.

Penetration is king

For brands in Kenya, growth will only come from expanding their shopper base. They must be ready to manage churn, through an ongoing mission to recruit buyers. Even the strongest brands are losing 40-50% of their shoppers each quarter, so regular activation is critical.

Accessibility is another high priority. Strong brands have a broad reach because they are available across all channels. They offer a wide range, with something to meet the needs of every type of consumer, and to fit every occasion.

Brands should innovate value-driven products that have multiple usage occasions, within the right pack, range, and price offering, and have products that are targeted at different shopper groups. While kiosks are the priority channel, there is a major opportunity to grow within key supermarkets and neighbourhood supermarkets.

Fill in the form on the right side of the page to download the latest report on Kenya’s FMCG market.

Get in touch

Current market realities and consumer outlook for 2024 in KenyaCurrent market realities and consumer outlook for 2024 in Kenya